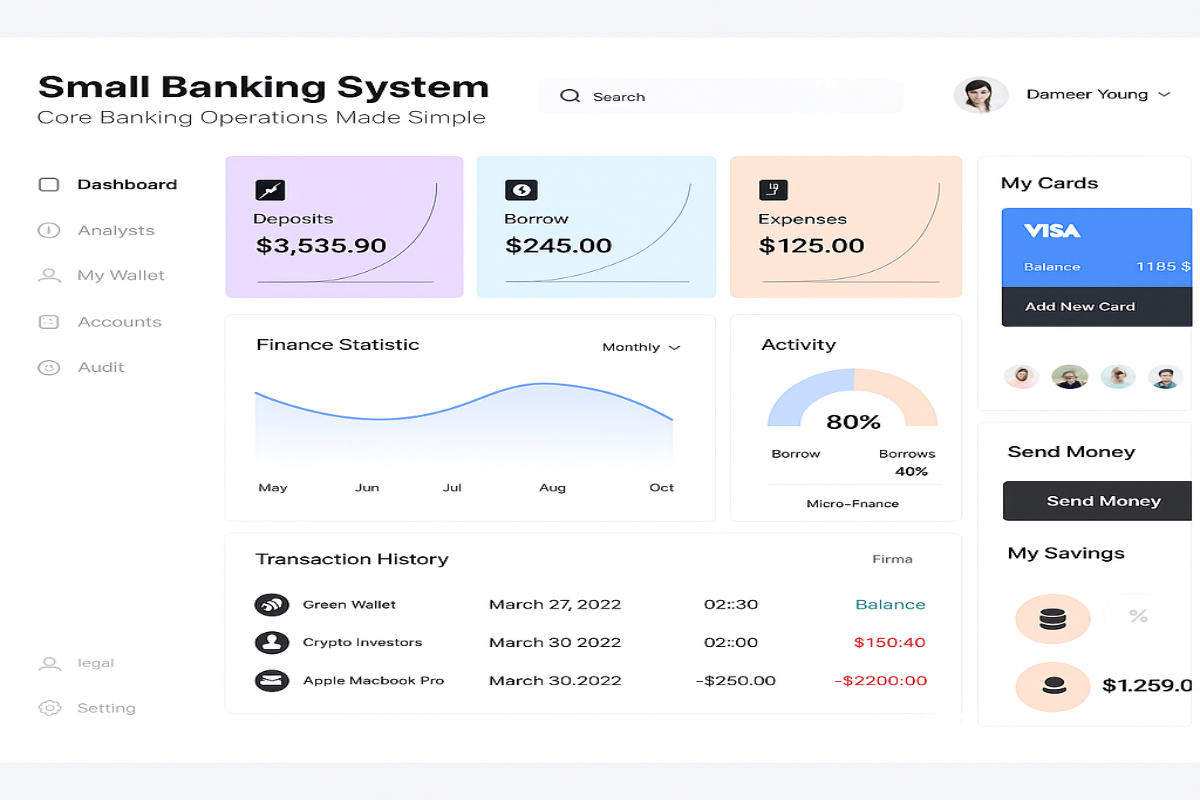

Problem

Small and mid-sized banks often rely on outdated legacy systems or fragmented tools that don’t support modern customer expectations. Manual interest calculations, lack of centralized customer data, and delays in report generation cause operational inefficiencies and regulatory risks.

(With rising compliance mandates and customer expectations for digital banking, small financial institutions need an affordable yet scalable core banking system.)

Solution

Small Banking System is a fully integrated web-based platform designed to handle core banking functions like savings, loans, deposits, and daily transactions—while enabling secure access, role-based controls, and regulatory compliance.

Digitized Daily Banking for Co-Ops & Credit Institutions

Customer Onboarding & KYC

Register new members with ID verification and document upload capabilities.

Savings & Current Account Modules

Manage account creation, deposits, withdrawals, and passbook entries digitally.

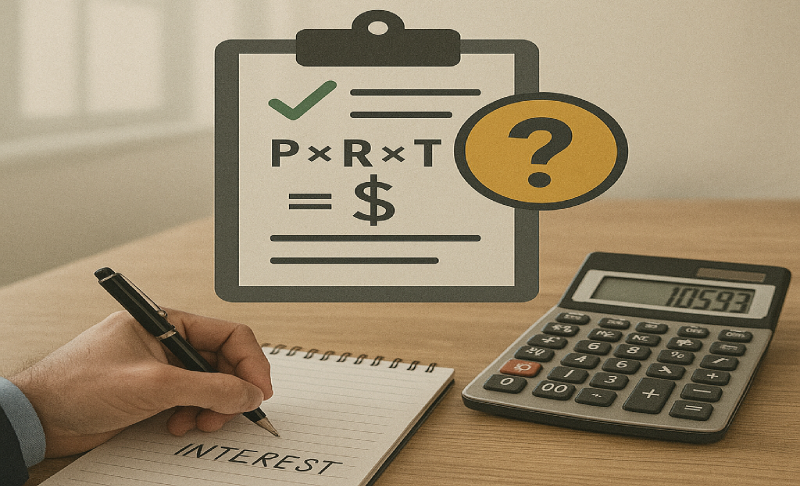

Loan Origination & EMI Tracking

Create custom loan products, set interest rules, and monitor repayment cycles.

Recurring & Fixed Deposit Support

Configure RD/FD schemes with maturity, interest payout, and renewal options.

Daily Cash & Journal Entries

Log teller-level transactions, contra entries, and cash book activities in real time.

Integrated Ledger & Accounting

Auto-generate ledgers, balance sheets, and trial balances with minimal effort.

Multi-Branch Management

Manage multiple branches from a single admin panel with user-level access

Automated Report Generation

Generate audit-ready reports for compliance, regulatory bodies, and management.

This Solution Solves For:

Lack of centralized system for deposits, loans, and member data

Manual interest calculations prone to error and inconsistency

No real-time tracking for EMI or deposit scheme maturity

Disjointed accounting, reporting, and auditing functions