Problem

NBFCs and financial institutions face challenges in managing FD/RD schemes due to outdated systems, manual workflows, and compliance-heavy processes. Errors in interest calculation, document verification, and premature withdrawal handling often lead to customer dissatisfaction and audit risks.

(A genuine industry challenge – As per RBI guidelines, NBFCs must maintain transparency and accuracy in interest payouts and KYC, yet most lack digitized systems to do so.)

Solution

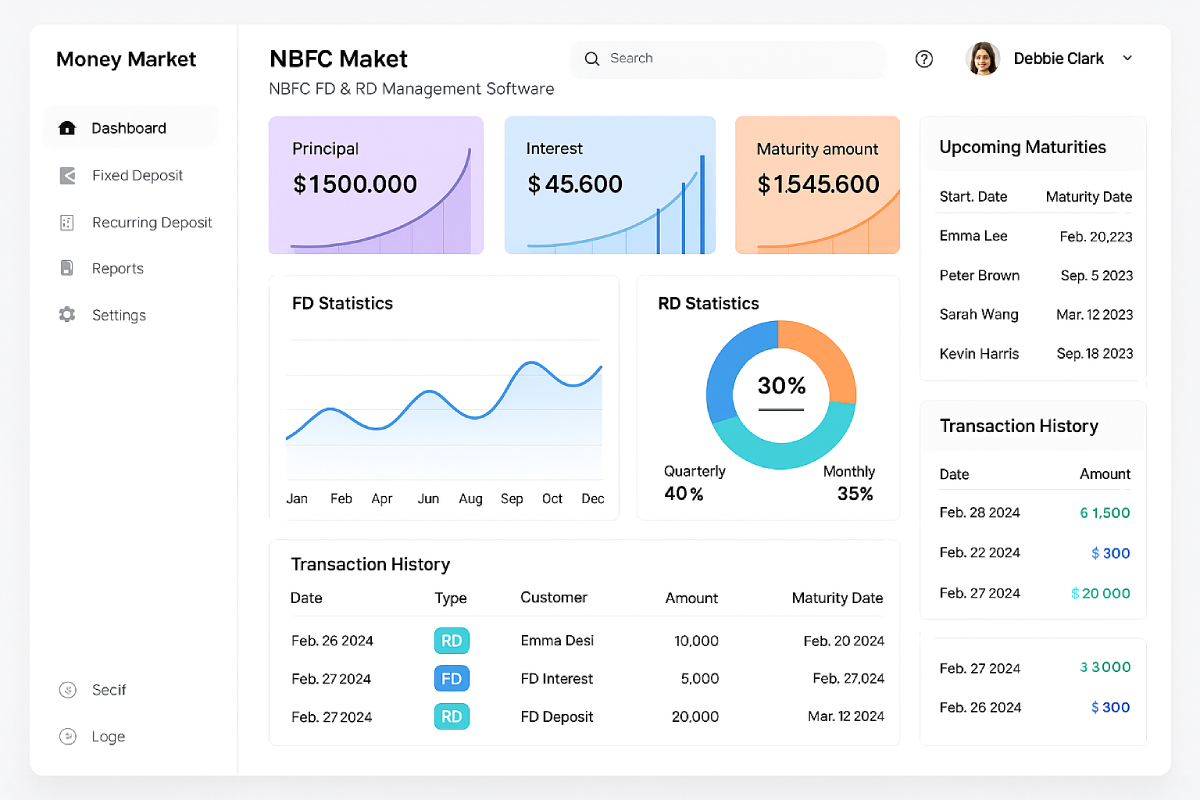

Money Market is a purpose-built platform for NBFCs to manage Fixed Deposit and Recurring Deposit schemes with automated workflows, compliance readiness, and seamless customer experience from onboarding to maturity.

Digitized FD/RD Operations. Built for NBFC Growth

Automate, monitor, and manage deposits — end-to-end.

Custom FD/RD Account Setup

Create deposit schemes with flexible tenures, interest slabs, and frequency rules.

Automated Interest & TDS Logic

System-calculated interest with built-in TDS deduction, penalties, and payout triggers.

Premature Withdrawal Handling

Auto-adjust payouts and apply penalties for early withdrawal cases with ease.

Digital KYC & Document Storage

Capture and store client KYC details securely with easy retrieval and audit trails.

Multi-Level Admin Dashboard

Manage accounts, agents, and branches with permission-based access panels.

Renewal & Maturity Alerts

Automated notifications sent to clients and admins before maturity or renewal.

Scheme Configuration Engine

Set unique rules per product—cumulative, non-cumulative, recurring, or flexible.

Compliance Reporting Tools

Generate TDS, ledger, interest certificates, and regulator-ready financial exports.

This Solution Solves For:

Manual interest calculations prone to error or delay

Lack of structured KYC and compliance tracking

Difficulty managing large deposit portfolios across branches

Delays in customer communication regarding maturity or renewal