Problem

Educational institutes and NBFCs often lose track of students after graduation, leading to delayed recoveries and rising defaults. Manual EMI tracking, disconnected employer data, and lack of borrower scoring create bottlenecks in recovering dues and evaluating repayment performance.

(Loan NPAs in the education sector are rising. A digital-first approach is necessary to improve recovery rates and reduce operational stress.)

Solution

Mpoweredu is a purpose-built educational loan recovery software that helps institutions manage borrower data, employer mapping, repayment tracking, and credit scoring—ensuring better recovery, faster response, and lower defaults.

Built to Streamline Recovery & Credit Scoring

Centralized Borrower Management

Create structured borrower profiles with academic, financial, and contact details.

Employer & Job Mapping Tools

Track graduate employment status and company mapping for loan coordination.

Credit Rating Engine

Generate borrower risk scores based on repayment trends and behavioral data.

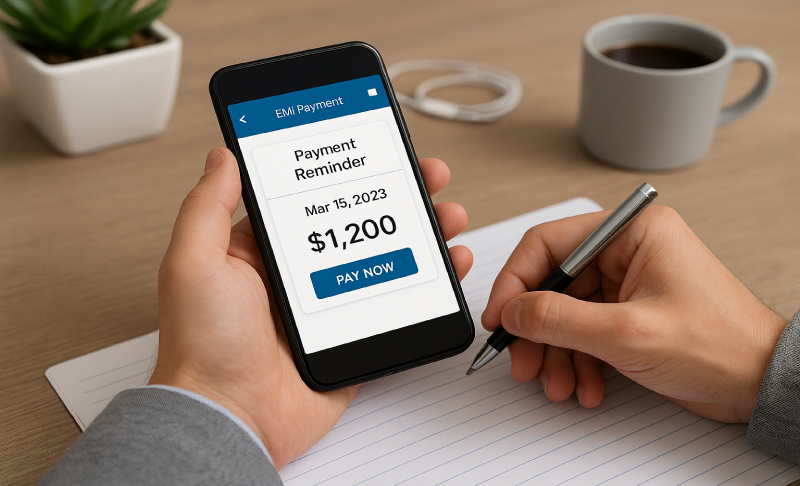

EMI Tracking & Alerts

Automated follow-ups with email/SMS reminders for upcoming or overdue payments.

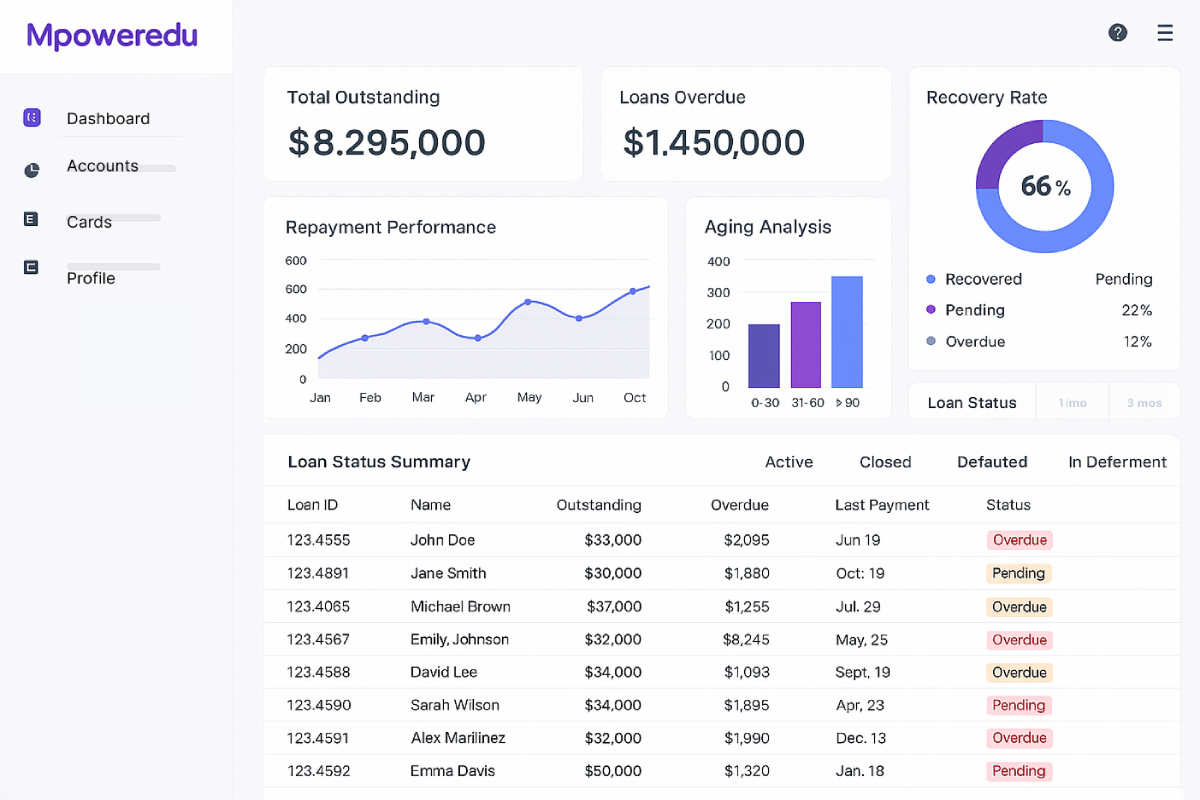

Institution & Admin Dashboards

Role-based dashboards for colleges, NBFCs, and recovery teams with live updates.

Multi-Level Access Control

Secure system access for field agents, admins, and college officials with audit logs.

Automated Report Generation

Generate reports by institution, region, employer, or borrower with filter options.

Bulk Upload & Search Utilities

Upload and manage large data sets of students, employers, and repayment records.

This Solution Solves For:

Lost contact with borrowers post-course completion

No employer coordination or job tracking system

Delayed EMI collections and fragmented communication

No framework to evaluate borrower credit risk