Executive Summary: Modular AI Enhancements for Gold Loans

Traditional gold loan processes often involve distinct stages, each presenting opportunities for improvement through Artificial Intelligence (AI). Exploring AI for Gold Loans offers a path to address challenges like manual customer checks, potential errors in weight recording, subjective item eligibility assessments, and disconnected calculation tools that hinder efficiency and customer experience. This explainer outlines several conceptual AI-powered modules – key components of modern AI solutions for gold lending – designed to address specific bottlenecks: AI Customer Verification, Automated Weighing Verification, AI-Driven Eligibility Identification, and Integrated Loan Calculation. While each module offers standalone benefits, they can also be combined into a comprehensive system for maximum gold loan process automation and optimization, showcasing the transformative potential of applying AI for Gold Loans.

1. The Challenge: Specific Bottlenecks in Gold Loan Processing

Context: The Gold Loan Operational Landscape

The gold loan sector requires balancing speed, security, and accuracy. Traditional, often manual, processes at different stages – from customer onboarding to final calculation – can create inefficiencies, increase operational costs, and impact risk management. The absence of integrated solutions, like effective AI for Gold Loans, often perpetuates these issues within the competitive financial services market. Addressing these bottlenecks individually or holistically is key to modernization.

Key Pain Points Addressed by AI (Module-Specific)

- (Customer Verification): Time lost manually searching for returning customer records and assessing history – a task ripe for AI automation.

- (Weighing Verification): Risk of human error or deliberate misreading/mis-entry of gold weight from scales, solvable with AI-driven verification.

- (Eligibility Assessment): Inconsistent or slow identification of whether specific gold items (biscuits, coins, jewelry types) qualify for loans, where AI in gold finance can provide standardization.

- (Loan Calculation): Disconnect between physical assessment and providing customers with quick, accurate loan estimates, hindering a seamless digital experience.

- Overall: Cumbersome workflows, potential for fraud at various stages, scalability issues, and suboptimal customer experience due to delays – all areas where AI for Gold Loans can deliver significant improvements.

Limitations of Traditional Approaches

Manual checks and siloed steps lack the integration, speed, and data-driven consistency offered by AI. Standard procedures struggle to adapt dynamically, scale efficiently, or provide the seamless digital experience customers increasingly expect, highlighting the need for intelligent gold loan processing.

2. The AI Solution Concepts: Targeted Modules for Enhancement

Vision & Objectives for AI-Powered Modules

The vision is to offer targeted AI solutions that address specific pain points in the gold loan lifecycle, allowing institutions to modernize incrementally or implement a fully integrated system powered by AI for Gold Loans.

- Objective (Module 1): Automate returning customer identification and history retrieval using facial recognition.

- Objective (Module 2): Provide automated, objective verification of gold item weight using image capture and OCR.

- Objective (Module 3): Enable rapid, AI-driven identification of gold item types to determine loan eligibility automatically.

- Objective (Module 4): Offer seamless integration for immediate, AI-informed loan estimations via customer-facing tools.

- Overall Objective: Enhance accuracy, reduce processing times, minimize manual effort, improve security, and offer flexible implementation options through strategic application of AI for Gold Loans.

3. How the AI Modules Work: Technology Explained

This section breaks down the distinct AI modules contributing to an effective AI for Gold Loans strategy.

3.1 Module: AI for Customer Verification

- Data Acquisition: Requires a clear photo of the customer initiating the loan process, captured via an app, website, or in-branch device. Access to the institution’s existing customer database (including photos and relevant history) is also needed.

- The AI Processing Pipeline:

- First, the submitted customer photo is processed using Computer Vision (AI enabling computers to interpret images) and facial recognition algorithms.

- Next, the system compares the facial features extracted from the photo against the images stored in the customer database.

- The system then identifies potential matches, confirming if the individual is a returning customer. If matched, relevant historical data (like payment history or previous loan details) can be automatically retrieved.

- Output & Interaction: The system outputs a verification status (e.g., “Verified Returning Customer”, “New Customer”, “Potential Match – Review Needed”) often displayed on the staff’s interface or integrated into the workflow logic. Associated customer history is presented if applicable.

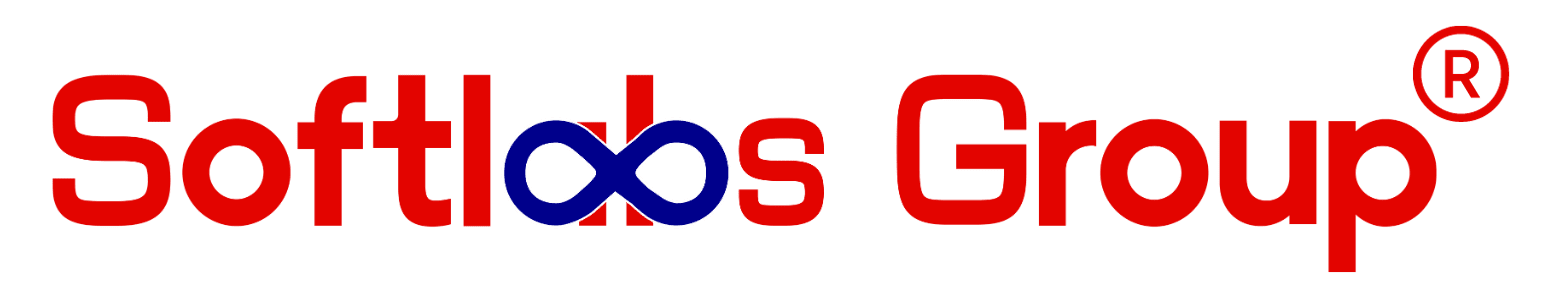

3.2 Module: AI for Weighing Verification

- Data Acquisition: Requires an image capturing the gold item placed on a digital weighing scale. Crucially, the image must clearly show the item, the scale itself, and the readable numeric display showing the weight.

- The AI Processing Pipeline:

- First, the uploaded image is analyzed using computer vision to identify the key elements: the scale, the gold item, and the digital display area.

- Once the display area is located, Optical Character Recognition (OCR) (Technology that extracts text from images) is applied specifically to that region.

- The system then automatically reads and extracts the numeric weight value directly from the image of the scale’s display. Optional checks can verify the presence of the gold item.

- Output & Interaction: The primary output is the digitally extracted weight value, which can be automatically populated into the loan application or verification system, minimizing manual entry errors. It provides an objective, verifiable record of the weight at a specific moment.

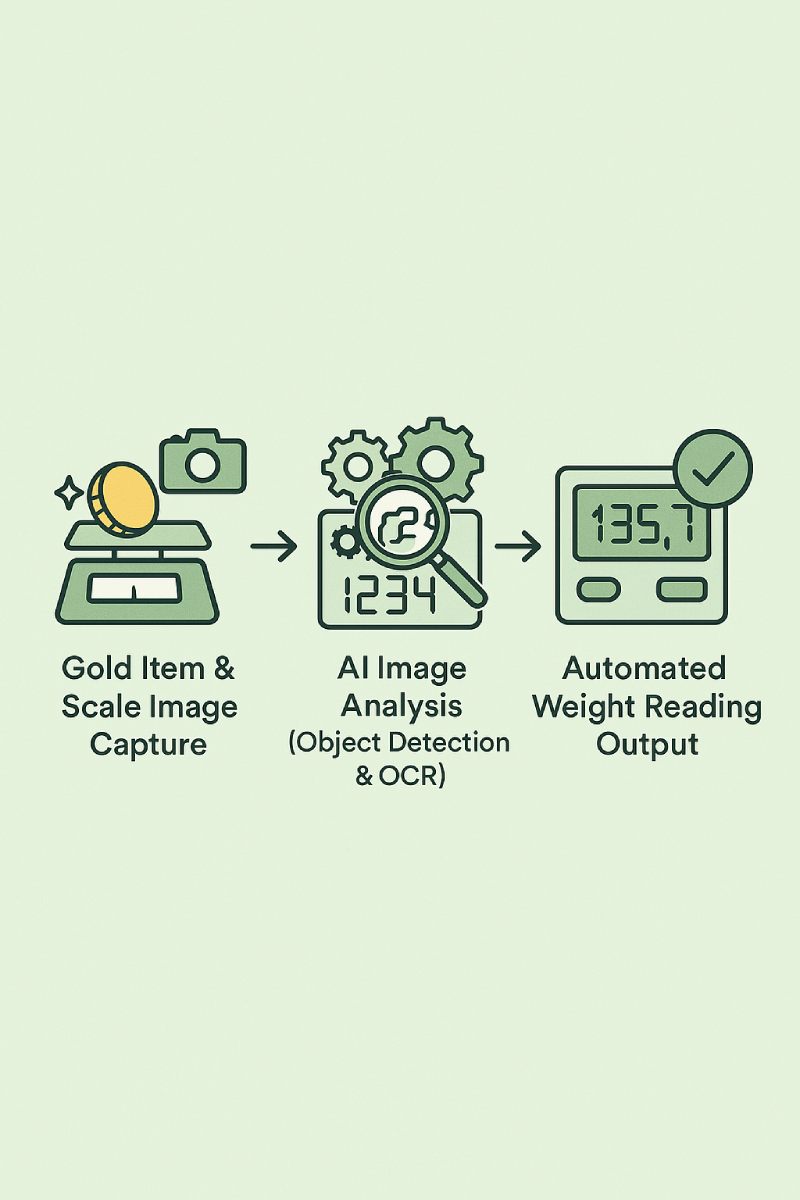

3.3 Module: AI for Gold Loan Eligibility Identification

- Data Acquisition: Requires a clear scan or photo of the gold item itself (e.g., biscuit, coin, specific jewelry type). Access to a pre-defined set of rules determining which item types are eligible for loans is necessary. A substantial image dataset of various gold items is needed for training effective AI models for gold assessment.

- The AI Processing Pipeline:

- First, the image of the gold item is processed by a Machine Learning (ML) (Algorithms allowing systems to learn from data) model, specifically a computer vision model trained on images of eligible and ineligible gold items.

- The model analyzes visual features (shape, texture, characteristics) to classify the item type (e.g., “Gold Coin – Type A”, “Jewelry – Ring”, “Gold Biscuit”).

- The system then compares the identified item type against the institution’s predefined eligibility rules.

- Output & Interaction: The system outputs a clear eligibility decision (e.g., “Eligible for Loan Processing”, “Ineligible Item Type”, “Requires Manual Review”). This can be displayed to staff or used to gate the progression of the loan application.

3.4 Module: AI-Informed Gold Loan Calculation Integration

- Data Acquisition: Requires inputs such as the verified weight (potentially from the automated weighing tool), item type/purity information (potentially inferred from the eligibility identifier or user input), and access to real-time gold price data feeds. Customer interaction occurs via the website or app.

- The AI Processing Pipeline (Integration Focus):

- Customers typically initiate this via a website or mobile app, potentially uploading an image (which could be processed by the eligibility identifier first) or entering details like weight and perceived purity.

- The system takes these inputs (verified weight if available, item type/purity) and combines them with real-time gold market prices fetched via an API (Application Programming Interface – a way for software systems to communicate).

- The integrated calculation engine then processes this data to compute an estimated loan amount based on the institution’s lending policies (Loan-to-Value ratio, etc.).

- Output & Interaction: The system presents an immediate, estimated loan amount directly to the customer through the website or app interface, providing transparency and accelerating the decision-making process, a key benefit of user-facing AI for Gold Loans.

3.5 Integrating the Modules for a Unified System

While each module above delivers value independently, their true power is unlocked when integrated into a cohesive AI for Gold Loans platform. Imagine a seamless flow:

- A customer uploads their photo (processed by the AI customer verification system for identification).

- They are prompted to photograph their gold on the scale (weight captured by the automated weighing verification tool).

- They then photograph the item itself (eligibility confirmed by the AI eligibility identification component).

- All verified data (identity, weight, eligibility) flows automatically into the integrated calculation engine, alongside real-time pricing.

- A highly accurate loan estimate is presented instantly.

This integrated approach minimizes data re-entry, reduces processing time dramatically, enhances accuracy across the board, and creates a streamlined experience for both customers and staff. Data flows automatically between stages, reducing manual touchpoints and potential errors, leading to significant operational efficiencies driven by AI in gold loan processing.

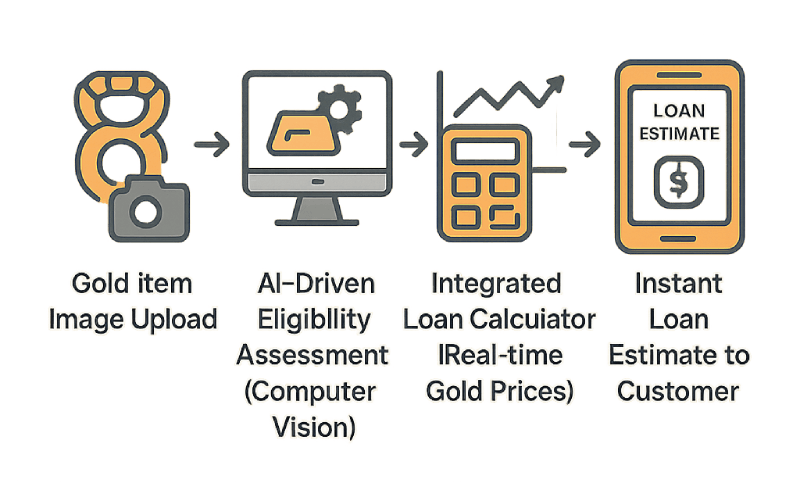

4. Key Enabling Technologies: Core Components

Successfully implementing AI for Gold Loans relies on several core technologies:

- Computer Vision: Essential for image analysis in customer verification, weight verification (object detection), and item identification.

- Machine Learning (ML): Powers the classification models used in eligibility identification and potentially aspects of facial recognition. Requires robust training data.

- Optical Character Recognition (OCR): Critical for accurately extracting the weight value from scale displays in the weighing verification module.

- API Integration: Crucial for connecting the modules to each other, to existing databases (customer, rules), external data feeds (gold prices), and user interfaces (web/app/internal tools).

5. Potential Impact & Benefits for Gold Loan Providers (Modular & Integrated)

Implementing AI for Gold Loans, whether as individual modules or a unified system, offers substantial benefits:

- Targeted Problem Solving: Address specific bottlenecks like verification speed or weighing accuracy with individual modules.

- Accelerated Processing: Each module reduces manual effort; integration provides end-to-end speed improvements.

- Enhanced Accuracy & Consistency: AI reduces human error in reading weights and applying eligibility rules consistently.

- Improved Fraud Detection: Automated checks at multiple points (identity, weight) strengthen security protocols.

- Increased Operational Efficiency: Frees up staff from repetitive tasks for higher-value activities, improving overall productivity.

- Better Customer Experience: Faster estimates, digital convenience, and transparent processing build trust and satisfaction.

- Scalability: AI solutions for gold lending handle volume increases more effectively than manual processes.

- Flexible Implementation: Start with the modules addressing the most critical pain points and integrate further over time.

6. Important Considerations for Implementation

Embarking on an AI for Gold Loans initiative requires careful planning around several key factors:

- Data Requirements: Quality and quantity of data (customer photos, diverse gold item images, scale images) are paramount for training accurate models for each relevant module.

- Integration Complexity: Connecting modules to each other and to existing systems requires careful planning and robust API development.

- Model Training & Maintenance: Each AI model needs specific training and ongoing monitoring/retraining to maintain performance and adapt to new data.

- Infrastructure: Sufficient computing resources are needed, potentially scaled based on the number and complexity of modules implemented.

- User Training & Adoption: Staff and potentially customers need clear guidance on using the new tools or interacting with the AI system.

- Regulatory & Ethical Considerations: Strict adherence to data privacy laws (like GDPR, CCPA, etc.) is essential, especially for customer photos. Ensuring fairness and mitigating bias in all AI for Gold Loans modules is critical.

- Environmental Factors: Image quality variations (lighting, angles) need to be handled robustly by the computer vision components.

7. Tailoring AI for Your Unique Needs with Softlabs Group

The AI modules described offer powerful ways to enhance specific parts of the gold loan process, or they can be combined for a fully transformative solution. Softlabs Group recognizes that the best approach to AI for Gold Loans depends on your specific operational context, existing infrastructure, and strategic priorities. Whether you need to tackle customer verification speed, ensure accurate weight capture, automate eligibility checks, provide instant calculations, or implement a fully integrated end-to-end system, our expertise lies in understanding your unique requirements. We design, develop, and integrate bespoke AI for Gold Loans solutions – modular or comprehensive – ensuring they deliver tangible results and align perfectly with your business goals. Partner with us to build the precise AI capabilities that will optimize your gold loan operations most effectively.